In August 2016, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update 2016-14 (ASU 2016-14) to make improvements to the communication of information on not-for-profit financial statements. ASU 2016-14 is effective for not-for-profit organizations with annual reporting periods beginning after December 15, 2017 (calendar year 2018 or fiscal year 2019). ASU 2016-14 focuses on the five main areas listed below, but this blog will provide information and implementation examples solely related to net asset classes, underwater endowments, and expiration of capital restrictions.

In August 2016, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update 2016-14 (ASU 2016-14) to make improvements to the communication of information on not-for-profit financial statements. ASU 2016-14 is effective for not-for-profit organizations with annual reporting periods beginning after December 15, 2017 (calendar year 2018 or fiscal year 2019). ASU 2016-14 focuses on the five main areas listed below, but this blog will provide information and implementation examples solely related to net asset classes, underwater endowments, and expiration of capital restrictions.

Five main areas of focus in ASU 2016-14:

- Net asset classes

- Investment return

- Functional expense reporting

- Liquidity and availability of resources

- Presentation of operating cash flows

NET ASSET CLASSES

Currently, all nonprofits classify their net assets into three categories: unrestricted, temporarily restricted, and permanently restricted. Under ASU 2016-14, unrestricted net assets are renamed “net assets without donor restrictions,” and temporarily restricted and permanently restricted net assets are combined into one category renamed “net assets with donor restrictions.” These two categories of net asset classes are the minimum required to be presented in the financial statements; however, an organization may further disaggregate them to provide more information, if desired. The Internal Revenue Service (IRS) has not yet revised the Federal Form 990 to accommodate the change in net asset classes; however, the 2018 Federal Form 990 instructions provide guidance on where and how to report “net assets without donor restrictions” and “net assets with donor restrictions.”

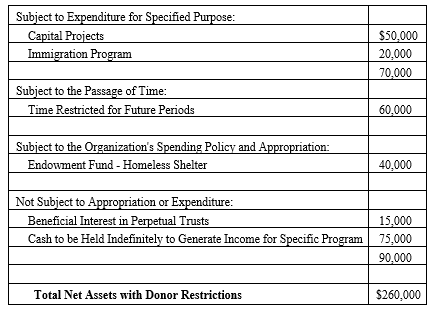

Net assets with donor restrictions include assets that are subject to donor-imposed restrictions. Under ASU 2016-14, information about the nature and amounts of different types of donor-imposed restrictions are required to be reported either on the face of the statement of financial position or in the notes to the financial statements.

An example of this requirement reported in the notes to the financial statements is as follows:

Net assets with donor restrictions consisted of the following as of December 31, 20XX:

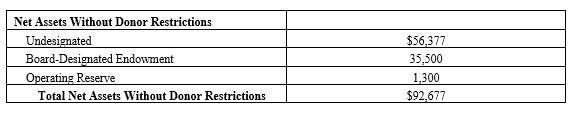

An example is as follows:

Net assets without donor restrictions may include assets whose use are limited due to limitations placed on them by the board of directors. Board-designated net assets may be earmarked for future programs, investment, contingencies, purchase or construction of fixed assets, or other uses. Under ASU 2016-14, nonprofits are required to enhance disclosures to include the nature and amounts of these board-designated net assets.

Bequests without donor restrictions are designated for long-term investment (board-designated endowment). This amount totaled $35,500 at December 31, 20XX. Additionally, the Board of Directors has established an operating reserve with the objective of setting funds aside to be drawn upon in the event of financial distress or an immediate liquidity need. This amount totaled $1,300 at December 31, 20XX.

UNDERWATER ENDOWMENTS

ASU 2016-14 also provides a definition of “underwater endowment funds” as “a donor-restricted endowment fund for which the fair value of the fund at the reporting date is less than either the original gift or the amount required to be maintained by the donor or by law that extends donor restrictions.” The new standard requires the following be disclosed by nonprofits with underwater endowment funds:

- Aggregate original gift amounts of underwater endowment funds

- Aggregate fair value of underwater endowment funds

- Aggregate amount of underwater funds

- Policy for spending underwater endowments

Additionally, prior to ASU 2016-14, underwater endowment funds were required to be reflected within unrestricted net assets. ASU 2016-14 changes that classification from unrestricted net assets to net assets with donor restrictions. As such, underwater endowment amounts may be netted against net assets with donor restrictions or shown as a separate line item within the net assets with donor restrictions classification on the face of the statement of financial position and in the endowment disclosure.

An example of an underwater endowment fund disclosure is as follows:

From time to time, the fair value of assets associated with individual donor-restricted endowment funds may fall below the level that the donor or the Uniform State Prudent Management of Institutional Funds Act (UPMIFA) requires the organization to retain as a fund of perpetual duration.

Deficiencies of this nature exist in three donor-restricted endowment funds, which together have an original gift value of $14,500, a current fair value of $13,416, and a deficiency of $1,084 as of December 31, 20XX.

These deficiencies resulted from unfavorable marked fluctuations that occurred shortly after the investment of new contributions for donor-restricted endowment funds and continued appropriation for certain programs that was deemed prudent by the board of directors.

EXPIRATION OF CAPITAL RESTRICTIONS

ASU 2016-14 requires that unless a donor stipulates otherwise, donations of property and equipment or cash that must be used to acquire property and equipment, must be released from “net assets with donor restrictions” when the asset is placed in service. The option to imply a time restriction that expires over the useful life of a contributed capital asset (including gifts restricted to acquire or construct such assets) has been eliminated.

Please contact your CPA or BLS professional with any questions or to request additional guidance regarding net asset classification and the implementation of ASU 2016-14.