Category: New Regulations

Enforcement of Beneficial Ownership Information (BOI)

March 04, 2025

The Corporate Transparency Act took effect in 2024 and required disclosure of beneficial ownership information (BOI) of certain entities. BOI reporting requirements have been suspended and reinstated several times over … Continued

Beneficial Ownership Information Reporting Requirements (BOI) – Reporting Reinstated

February 25, 2025

On February 18, 2025, The U. S. District Court for the Eastern District of Texas lifted the nationwide injunction in the Smith, et al. v. U. S. Department of … Continued

Beneficial Ownership Information (BOI) Reporting Requirements – Suspension Reinstated

January 07, 2025

In a turn of events, a federal appeals court issued another ruling that suspends a requirement for businesses to file reports about their beneficial ownership information (BOI). This came just … Continued

Beneficial Ownership Information Reporting Requirements (BOI) – Suspension Lifted

December 26, 2024

On December 23, 2024, the Fifth Circuit Court of Appeals granted a Department of Justice motion to lift an injunction put in place by a district court ruling on December … Continued

Business Alert: BOI Reporting Requirements Have Been Suspended for Now

December 16, 2024

New beneficial ownership information (BOI) reporting requirements that many small businesses were required to comply with by January 1, 2025, have been suspended nationwide under a new court ruling. However, businesses … Continued

How much can you contribute to your retirement plan in 2025?

November 21, 2024

The IRS has issued its 2025 inflation-adjusted contribution amounts for retirement plans in Notice 2024-80. Many retirement-plan-related limits will increase for 2025 — but less than in prior years. Thus, depending … Continued

Reminder – Important Corporate Transparency Act Deadline Approaching

November 13, 2024

The Corporate Transparency Act (CTA) was enacted into law as part of the National Defense Act for Fiscal Year 2021. The CTA requires the disclosure of the beneficial ownership information … Continued

What is the Delaware EARNS Program?

August 21, 2024

If you are a Delaware employer with 5 or more employees, please pay careful attention to the following information regarding the Delaware EARNS program. The Delaware EARNS (Expanding Access for … Continued

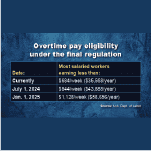

Federal Regulators Expand Overtime Pay Requirements, Ban Most Noncompete Agreements

May 09, 2024

The U.S. Department of Labor (DOL) has issued a new final rule regarding the salary threshold for determining whether employees are exempt from federal overtime pay requirements. The threshold is … Continued

IRS Issues Guidance on Tax Treatment of Energy Efficiency Rebates

April 29, 2024

The Inflation Reduction Act (IRA) established and expanded numerous incentives to encourage taxpayers to increase their use of renewable energy and adoption of a range of energy efficient improvements. In … Continued