Category: Tax

4 Year-End Planning Steps to Trim Your 2025 Taxes

November 25, 2025

Now is the time of year when taxpayers search for last-minute moves to reduce their federal income tax liability. Adding to the complexity this year is the One Big Beautiful … Continued

Minimize Your Business’s 2025 Federal Taxes by Implementing Year-End Tax Planning Strategies

November 24, 2025

The One Big Beautiful Bill Act (OBBBA) shifts the landscape for year-end tax planning. The law has implications for some of the most tried-and-true tax-reduction measures. It also creates new … Continued

What do the 2026 Cost-of-Living Adjustment Numbers Mean for You?

November 04, 2025

The IRS recently issued its 2026 cost-of-living adjustments for more than 60 tax provisions. The OBBBA makes permanent or amends many provisions of the Tax Cuts and Jobs Act (TCJA). … Continued

How will the Changes to the SALT Deduction Affect Your Tax Planning?

September 04, 2025

The One Big Beautiful Bill Act (OBBBA) shifts the landscape for federal income tax deductions for state and local taxes (SALT), albeit temporarily. If you have high SALT expenses, the … Continued

President Trump Signs His One, Big, Beautiful Bill Act into Law

July 09, 2025

On July 4, President Trump signed into law the far-reaching legislation known as the One, Big, Beautiful Bill Act (OBBBA). As promised, the tax portion of the 870-page bill extends … Continued

It’s not too late for 2024 tax considerations

November 25, 2024

Many of the Tax Cuts and Jobs Act provisions are set to expire at the end of 2025, absent congressional action. However, with President-Elect Donald Trump set to take power … Continued

How will the 2025 Inflation Adjustment Numbers Affect Your Year-End Tax Planning?

October 28, 2024

The IRS has issued its 2025 inflation adjustment numbers for more than 60 tax provisions in Revenue Procedure 2024-40. Inflation has moderated somewhat this year over last, so many amounts will … Continued

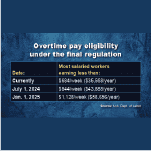

Federal Regulators Expand Overtime Pay Requirements, Ban Most Noncompete Agreements

May 09, 2024

The U.S. Department of Labor (DOL) has issued a new final rule regarding the salary threshold for determining whether employees are exempt from federal overtime pay requirements. The threshold is … Continued

IRS Extends Relief for Inherited IRAs

May 02, 2024

For the third consecutive year, the IRS has published guidance that offers some relief to taxpayers covered by the “10-year rule” for required minimum distributions (RMDs) from inherited IRAs or … Continued

IRS Issues Guidance on Tax Treatment of Energy Efficiency Rebates

April 29, 2024

The Inflation Reduction Act (IRA) established and expanded numerous incentives to encourage taxpayers to increase their use of renewable energy and adoption of a range of energy efficient improvements. In … Continued