How will the 2025 Inflation Adjustment Numbers Affect Your Year-End Tax Planning?

October 28, 2024

The IRS has issued its 2025 inflation adjustment numbers for more than 60 tax provisions in Revenue Procedure 2024-40. Inflation has moderated somewhat this year over last, so many amounts will … Continued

Ease the Financial Pain of Natural Disasters with Tax Relief

October 11, 2024

Hurricane Helene and Hurricane Milton have affected millions of people in multiple states across the southeastern portion of the country. It’s just some of many weather-related disasters this year. Indeed, … Continued

Taxes Take Center Stage in the 2024 Presidential Campaign

October 04, 2024

Early voting for the 2024 election has already kicked off in some states, but voters are still seeking additional information on the candidates’ platforms, including their tax proposals. The details … Continued

What is the Delaware EARNS Program?

August 21, 2024

If you are a Delaware employer with 5 or more employees, please pay careful attention to the following information regarding the Delaware EARNS program. The Delaware EARNS (Expanding Access for … Continued

IRS Issues Final Regulations on Inherited IRAs

August 05, 2024

The IRS has published new regulations relevant to taxpayers subject to the “10-year rule” for required minimum distributions (RMDs) from inherited IRAs or other defined contribution plans. The final regs, … Continued

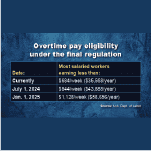

Federal Regulators Expand Overtime Pay Requirements, Ban Most Noncompete Agreements

May 09, 2024

The U.S. Department of Labor (DOL) has issued a new final rule regarding the salary threshold for determining whether employees are exempt from federal overtime pay requirements. The threshold is … Continued

IRS Extends Relief for Inherited IRAs

May 02, 2024

For the third consecutive year, the IRS has published guidance that offers some relief to taxpayers covered by the “10-year rule” for required minimum distributions (RMDs) from inherited IRAs or … Continued

IRS Issues Guidance on Tax Treatment of Energy Efficiency Rebates

April 29, 2024

The Inflation Reduction Act (IRA) established and expanded numerous incentives to encourage taxpayers to increase their use of renewable energy and adoption of a range of energy efficient improvements. In … Continued

President Biden’s Proposed Budget Highlights Tax Agenda

March 21, 2024

President Biden has released his proposed budget for the 2025 fiscal year, which includes numerous tax provisions affecting businesses and individual taxpayers. While most of these provisions have little chance … Continued

The IRS Unveils ERTC Relief Program for Employers

January 25, 2024

Since July 2023, the IRS has taken a series of actions in response to what it has termed a “flood of ineligible claims” for the Employee Retention Tax Credit (ERTC). Most … Continued